Factors such as rising labour costs, skills shortages and geopolitical uncertainties can have a significant impact on production costs. Examples include the pandemic and semiconductor supply shortages. Such external influences can have a significant impact on production processes and make decision-making more difficult. Furthermore, it has been demonstrated that supply dependencies and/or outdated price agreements with customers or suppliers are associated with risks that can limit operational flexibility.

A sustainable company takeover requires not only comprehensive planning, but also a precise analysis of the existing cost structures. Cost control and transparency are key elements. The ability to adequately quote for new contracts and to know the profit indicators of existing projects are essential to the success of a company in the short and long term.

An integral part of this transition is the systematic application of due diligence. However, this process of detailed company auditing can be extended beyond traditional analyses to include more specialised methods such as cost engineering and value management. With these approaches, overhead cost structures, products, services and production processes can be analysed in detail and strategically optimised. Ensuring cost clarity is therefore of crucial importance to a successful company takeover. It is the cornerstone of a solid financial foundation and is indispensable.

Identify optimisation potential

Potential management successors typically require more insights to understand the company’s operational processes. In order to identify optimisation potential and derive appropriate measures, it is essential to gain insight into the production processes and to develop a deep understanding of the technologies used and the supply structures.

Decisive cost issues when taking over a company

The following questions might be asked by a new management when taking over a company:

- Are the pricing structures understandable, up-to-date and competitive?

- Are the processes and production facilities profitable?

- Are direct and indirect human resources being used optimally?

- Are production processes in line with production volumes?

- Does the overhead structure used in the calculation correspond to the real situation?

Cost analysis: a key to sustainable competitiveness

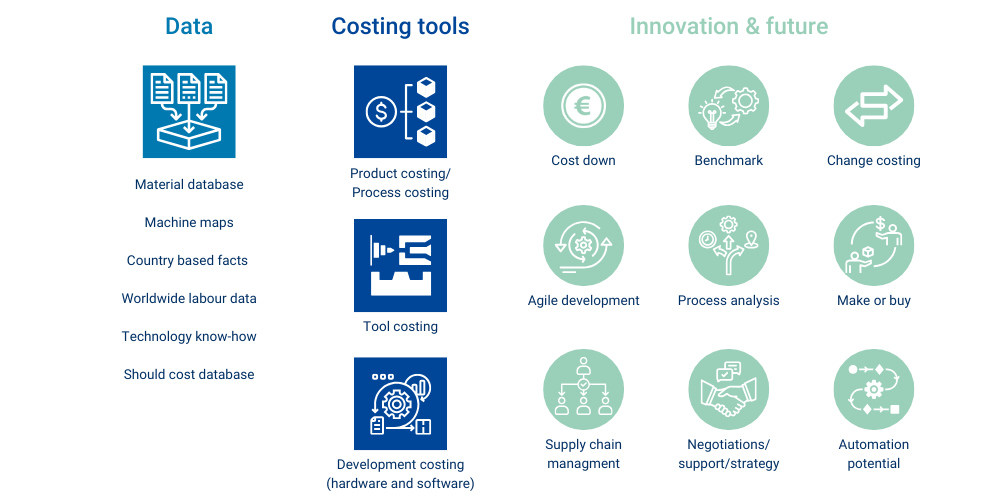

With a clearly structured plan and the targeted use of strategic tools to analyse costs, the challenge of a business takeover can be turned into an opportunity for long-term success. The AWS portfolio provides an incomparable basis for cost calculations using a variety of innovative tools.

Possible cost engineering and innovation approaches:

Product Costs

- Product cost reductions

- Adjustment of pricing

- Determination of value and success of existing products

- Optimisation of quantities

- Material adjustments

- Sustainability

Production Costs

- Analyse and optimise hourly machine rates

- Recognising potential through automation (cost-benefit analysis)

- Integrate new technologies

Wages and salaries

- Analysing employee costs

- Comparison of labour costs at different locations

- Eliminating the shortage of skilled labour

Supplier structures

- Analyse supplier network and restructure if necessary

- Make or buy decisions

- Quantities and purchasing

Logistics costs

- Packaging costs

- Transport costs

- Storage costs of goods

Depending on individual requirements, the above AWS calculation tools can be used for selected cost situations to support the management transition. The aim is to create an overview in order to optimally support decision-making and implementation processes. For this purpose, the first step is to analyse the company, its products or production processes, for example. All relevant information is systematically recorded in order to subsequently initiate cost reduction measures in the respective areas. One advantage here is the ability to analyse the cost statements in certain ‘scenarios’. This allows new approaches to be tested by changing the premises on a purely calculative basis, so that new production locations, alternative supply chains or certain product diversifications can be quickly calculated and more easily evaluated.

From cost analysis to strategic planning for the future

In addition to the enhancement of existing structures, the integration of innovative approaches has the potential to yield substantial benefits. Further benchmarking with competitors can help identify areas for improvement and uncover market trends, new features and differentiators. These insights are instrumental not only in the product development, but also in the evaluation and adaptation of internal production processes and investment decisions.

External expertise: Overcoming operating patterns and achieving optimisation during company takeovers

The support of external expertise is invaluable in overcoming existing and entrenched operating patterns within the organisation and in identifying objective measures for improvement. The unbiased view provided by an external observer makes it possible to recognise previously unnoticed operational challenges and develop new solutions.

This new and critical perspective is extremely helpful, especially in the context of a company takeover, as the individual taking over the company is likely to be following well-established paths. External expertise makes a decisive contribution to initiating sustainable optimisation within the company.

Mastering a business takeover: benefit from 20 years of experience in cost and value analysis

Take the lead with a strong partner at your side! Benefit from over 20 years of experience in cost and value analysis. Our proven tools and in-depth expertise will help you run your business efficiently and profitably.

Contact now

Make a successful start in your new role – contact us to find out how we can help you make a manageable transition and achieve your goals!